Gas service and supply plan

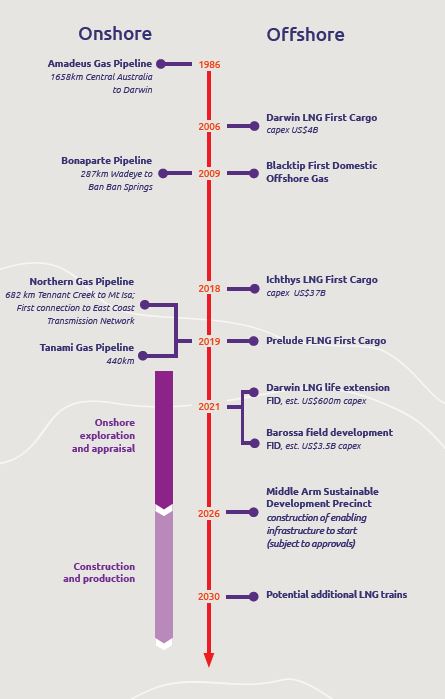

We have a vision that by 2030 the Territory will be a world class gas production, manufacturing and services hub.

Supporting this, we have a 5 point plan to:

- expand Darwin's LNG hub

- grow the service and supply industry

- establish a gas-based processing and manufacturing hub

- grow local research, innovation and training capacity

- contribute to Australia's energy security.

Growing the Territory's gas service and supply industry and maximising local content is key to building a vibrant and resilient economy.

The gas service and supply plan is about delivering jobs, growth and benefits for all Territorians.

We have a goal that by 2025 local participation in the gas industry supply chain will be at least 50%.

This has the potential to add an additional $1 billion to the Territory economy over the next 10 years.

Read the gas services and supply plan 2023 PDF (700.1 KB)

Find out how the Territory is developing a world class gas production, manufacturing and services hub at the Territory Gas Strategy website.

Delivering for Territorians

When the gas service and supply plan was first launched in 2019, the Territory supported 3 LNG projects. Related service and supply work was worth an estimated $400 million per annum and local businesses were capturing around $100 million1.

In 2021, the industry was estimated to be worth $630 million per annum with local business capturing $95 million of this work2. The overall size of the industry has grown but Territory businesses capturing the work has remained around the same.

The Northern Territory Government is working with industry to increase the share to Territory businesses.

Onshore exploration and appraisal of the Beetaloo Sub-basin is underway, and based on interstate experience3, the size of the opportunity for Territory businesses could be substantial in coming years as onshore projects move into construction and operation phases.

This will be achieved through the 3 focus areas of the gas service and supply plan:

- strengthen the commitment to local content by gas operators and contractors

- grow the local workforce and business capability

- strategically develop the service and supply ecosystem.

1. Strengthen the commitment to local content by gas operators and contractors

Actions

- Strengthen self-reporting by gas operators and contractors on Northern Territory contract spend and proportion of local content.

- Encourage and increase the use of government-sponsored services such as ICN NT, AusIndustry, and workforce training programs.

- Establish an Onshore Gas Supply Chain Working Group to collaboratively increase local content.

- Strengthen gas operators and contractors commitment to the Territory benefit policy.

- Engage with gas operators and contractors to improve procurement practices that increase local content.

- Leverage the advantages of the Offshore Supply Chain Working Group, focused on increasing local content.

2. Grow the local workforce and business capability

Actions

- Support and empower business to strengthen their strategy, planning and systems.

- Provide business avenues to develop tendering strategies and approaches for success.

- Partner with training organisations to build the Territory’s workforce capacity to increase workforce participation.

- Build on ICN offshore study, initially focusing on contracts where Northern Territory (NT) capacity exists and can compete.

- Build on ICN onshore study, focusing on businesses that have capacity to deliver.

- Support and empower NT service and supply businesses to be ‘export ready’.

- Partner with Australian Government (for example, AusIndustry) to deliver programs that build NT business capability and competitiveness, and enable businesses to overcome barriers to local industry participation.

- Work with land councils, local governments and communities to maximise local employment opportunities that support the industry.

- Facilitate partnership pathways with proponents, contractors and industry bodies to strengthen business relationships.

3. Strategically develop the service and supply ecosystem

Actions

- Facilitate the development of Darwin’s ship lift and marine industry park.

- Identify and promote a pipeline of potential service and supply investment opportunities (for example, proppants and water management).

- Development of infrastructure ‘activation projects’, working with proponents and government (for example, Northern Australia Investment Fund support).

- Drive the development of service and supply export opportunities in our region.

- Identify and facilitate investment opportunities in enabling infrastructure (for example, common-user facilities).

- Drive Middle Arm Sustainable Development Precinct planning to facilitate the establishment of a gas-based manufacturing sector.

- Promote successful infrastructure case studies to build the Northern Territory brand and reputation.

- Investigate policy, regulation, strategy and marketing strategies to support the development of the oil and gas industry.

To help Territory businesses capture opportunities, government continues to facilitate and invest in enabling infrastructure including:

- ship lift

- Marine Industry Park

- roads

- renewable energy supply

- Middle Arm Sustainable Development Precinct - planning and servicing.

The onshore opportunity

The Industry Capability Network (ICN) has prepared a report that identifies the scope and scale of emerging opportunities for Territory businesses in the onshore gas sector.

Statement of capacity Northern Territory (NT) onshore gas support industry, through extensive desktop research and field studies of the onshore industry in Queensland and the USA, identified 118 work scopes needed to support the success case in an onshore gas industry.

The report concluded that the NT service and supply sector has a very high capacity to meet the majority of these work scopes, and identified potential gaps in speciality areas.

To read this final report, go to the ICN website.

Case study: Winnellie Hydraulics

Winnellie Hydraulics is a proudly local, family-owned business, established by Richard Nicholson in Darwin in July 1983. Winnellie Hydraulics has built its reputation from the ground up as ‘the go-to’ specialist hydraulic company, in the Northern Territory (NT).

The company remains in the family with Max Nicholson (Richard’s son) now serving as general manager with a focus on maintaining the company’s first-class service levels and strong reputation in the industry. Winnellie Hydraulics is passionate about its business with innovation and continuous improvement at the forefront of its purpose to service large resources industries and companies across both the NT and beyond.

Originally specialising in the service of hydraulic components in the transport, commercial fishing and earth moving industries Winnellie Hydraulics grew with the rest of the Territory to develop a name for itself amongst the larger resource industries as they began to expand their presence around the NT.

View the transcript of the gas service and supply plan: Winnellie Hydraulics video.

View the full transcript of the gas service and supply plan: Winnellie Hydraulics video.

Contact us

For further information on the plan contact Industry Strategy:

Phone: 08 8946 9559

industrystrategy@nt.gov.au

Related information

- Northern Territory gas strategy: 5 point plan

- Middle Arm Sustainable Development Precinct

- ICN NT statement of capability Northern Territory onshore gas support industry

1 Source: ICN industry capability mapping and gap analysis offshore gas Industry 2019

2 ICN NT industry capability mapping and gap analysis offshore gas industry FY 2021

3 The scale of growth is based on modelling from Queensland - Lawrence Consulting, 2019. Economic impact of Queensland petroleum and gas sector 2011-18 (prepared for APPEA).

Give feedback about this page.

Share this page:

URL copied!